Cracking the Code: What Credit Card Marketing Can Teach Social Media Pros About Gen Z Acquisition

Guest post by Rucha Pandit, ListenFirst’s VP, Tech Enabled Services

Credit card brands are quietly outperforming in Gen Z acquisition. Here’s what social strategists can learn from their playbook.

Social pros excel at engagement, but real growth lies in acquisition. Surprisingly, some of the strongest Gen Z marketing comes from financial services. Credit card brands, often seen as conservative, are running high-converting campaigns across TikTok, LinkedIn, and YouTube. From values-driven messaging to hyper-personalized funnels, they’re setting a new bar for performance strategy. Let’s break down what they’re doing—and what social intelligence partners can borrow to drive better competitive benchmarking and actionable social media insights.

1. Performance Marketing with Teeth

In an era where “brand awareness” often becomes a proxy for progress, credit card marketers remain tethered to outcomes. Likes or shares don’t define success, but by applications completed and cards approved. This hard-wired performance DNA makes their tactics especially relevant for social teams looking to sharpen their acquisition strategy and improve their social media analytics reporting.

- MHP/Team SI ran a laser-focused campaign that delivered a 236% increase in credit card applications while keeping the cost per completed app at $55, well below the industry’s $72 benchmark.

- CreditStacks leveraged LinkedIn with surgical precision, scaling applications by 150% month-over-month without increasing CAC.

- Akbank’s Twitter-first push not only increased sales by 35%, but the leads it drove had a 5% higher approval rate—proof that channel choice matters.

What to Steal: Optimize every step of your funnel, not just the top. Track cost-per-conversion, not just reach or engagement. Get comfortable with bottom-funnel metrics and use social media metrics reports to inform decision-making.

2. Gen Z Cares About Ethics—And Credit Cards Know It

Gen Z isn’t just watching your content—they’re weighing your values. This generation prizes ethical alignment and environmental accountability, and financial brands are responding with purpose-led products that resonate deeply:

- The Carbon Zero Visa puts climate action in users’ hands by calculating carbon footprints and rewarding eco-friendly behavior.

- AmEx Cause Campaigns increased user adoption by 17% and usage by 28%, simply by linking card use to charitable donations.

- Bank of the West’s “1% for the Planet” card turned environmental impact into a branding differentiator, creating buzz across Instagram and YouTube.

What to Steal: Don’t bolt on impact. Make it foundational. Gen Z sees through surface-level cause marketing—authenticity and integration are key. Use social media software to surface what values are driving conversations in your category.

3. Personalization Is Table Stakes

Gen Z grew up customizing everything from playlists to sneakers. It’s no surprise they expect the same flexibility from financial tools. For credit card marketers, personalization isn’t a perk—it’s a prerequisite.

- Nearly half of Gen Z prefers customizable rewards.

- Mastercard reports this cohort is 2.5x more likely than boomers to expect personalized digital interactions.

- SoFi’s TikTok rewards explainer series segmented videos by persona—freelancers, side hustlers, and grads—leading to a 23% boost in video completions.

What to Steal: Get specific. Generic CTAs don’t cut it. Tailor messaging by audience type and align incentives to their real-world priorities. Leverage owned media analytics to identify which messages resonate most.

4. Gamify the Funnel

Financial literacy is a hurdle, and gamification is proving to be a powerful unlock. By turning credit education into interactive challenges, brands are making the journey both fun and functional:

- Flourish Fi and Bloom Credit use point systems and trackers to encourage healthy money habits.

- Chime leveraged swipe quizzes and streaks via Instagram Stories to teach users about credit scores in bite-sized formats.

What to Steal: Turn your funnel into a game. Use progress bars, unlockable milestones, and interactive storytelling to keep audiences engaged from first impression to final conversion. Tap into social media consulting to design reward loops that encourage action.

5. Omnichannel Isn’t Dead—It’s Evolved

Seamlessness is no longer a nice-to-have—it’s an expectation. Leading credit card brands are ensuring that a social ad can lead directly to a signup, with no friction in between.

- Chase Sapphire wove together a travel content series that flowed from YouTube to TikTok to Instagram DMs, offering Gen Z users curated travel perks tied to card signups.

- SoFi and Varo bridge mobile, desktop, and retail channels to meet users wherever they are and efficiently move them through the funnel.

What to Steal: Don’t let your funnel end with the post. Use retargeting, DMs, and integrated email flows to build continuity across every touchpoint. Present-ready reporting can help track each step’s impact.

6. Influencers Are the New Onboarding Team

Creators aren’t just spreading awareness—they’re driving applications. In the world of credit cards, influencer content now outperforms traditional branded media across nearly every conversion metric:

- Finfluencer-led content sees 11.7x higher conversion rates and 8.2x more engagement.

- Influencer partners can earn up to $300 per approved app—blurring the line between storytelling and performance.

- Top cards like Chase Sapphire, AmEx Platinum, and Discover Student now regularly appear in lifestyle, travel, and budgeting content.

What to Steal: Think of creators as educators. Find partners who can demystify complex offerings while nudging followers toward action. Use curated social media reporting to identify which partnerships actually drive ROI.

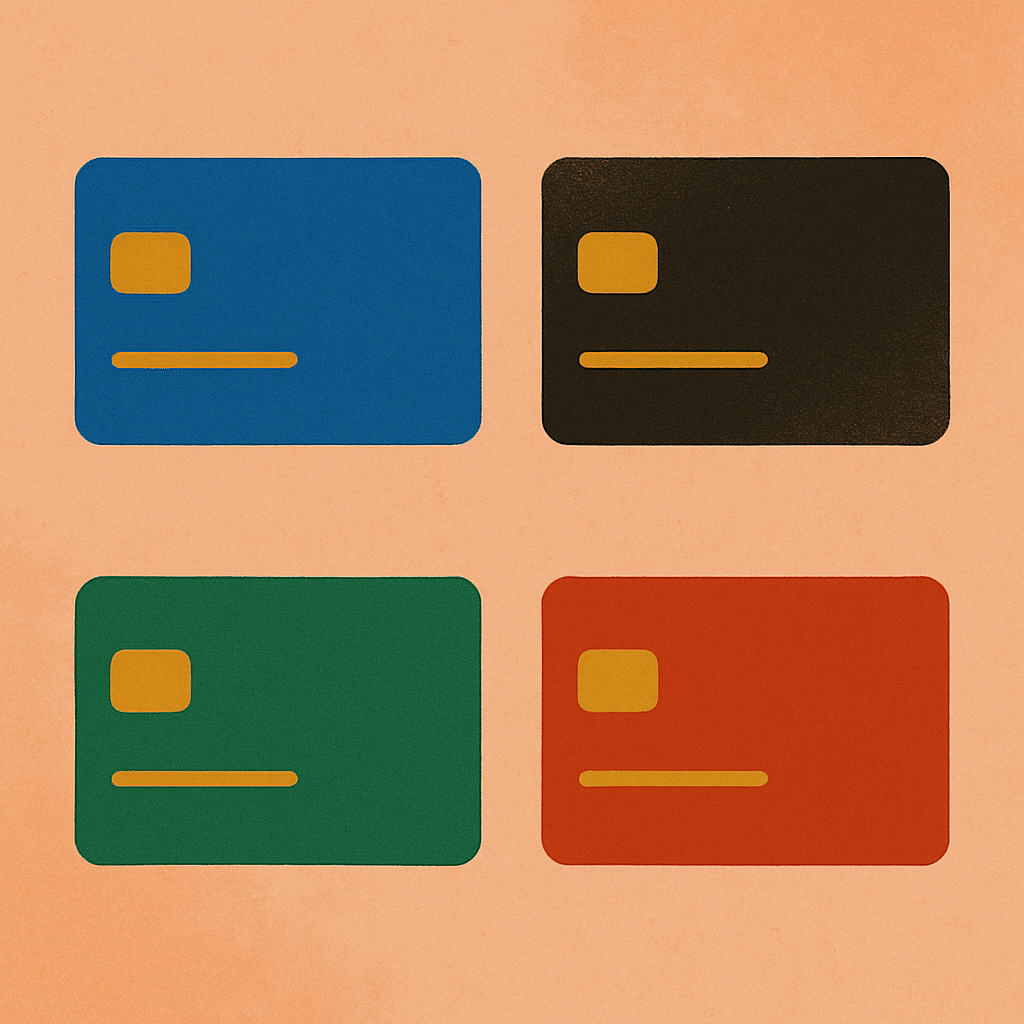

7. Creative Design Drives Behavior

Aesthetics aren’t just superficial—they’re strategic. Credit card colors and materials have been shown to influence perceptions of trust, status, and functionality.

- Blue signals stability and travel savviness.

- Black/Gold suggest prestige.

- Green appeals to the eco-minded.

- Red/Orange drive urgency and energy.

Case in point: Chase Sapphire Reserve teamed up with artist Shantell Martin to release a limited-edition design. Debuted in Harper’s Bazaar, the card straddles fashion and finance, using cultural cachet to turn plastic into a conversation piece. This wasn’t just about aesthetics; it was a repositioning move, aimed squarely at Gen Z’s style-first sensibilities.

What to Steal: Don’t be afraid to go against the creative mold. This campaign worked because it was familiar in fashion but unexpected in finance. Look for cultural crossovers that turn your product into a lifestyle accessory. Use creative content analysis to assess which visuals drive the most engagement.

8. Know the Compliance Rules Before You Copy

Financial services are among the most heavily regulated industries, and for good reason. If you’re adapting their tactics, be sure you’re also adapting their compliance mindset:

- TILA / Reg Z: Clear disclosures are required when mentioning rates or terms.

- CARD Act: Restricts youth marketing without income verification.

- UDAAP: Prohibits misleading or overly vague claims.

- CAN-SPAM & TCPA: Demand explicit opt-ins for email and SMS.

- FCRA: Governs pre-qualification and credit-based targeting.

What to Know: Transparency isn’t optional. Include terms in-creative and always disclose sponsored partnerships.

Key Takeaways for Marketers

- Treat social as a performance engine, not just a content channel

- Segment and personalize at every stage of the funnel

- Gamify learning and reward interaction

- Build cross-platform handoffs that feel native

- Let your visual design work harder for conversion

- Understand compliance to avoid costly missteps

- Use enterprise social media analytics to inform next steps

- Track share of voice growth and brand health metrics

- Deliver insights for decision-makers with executive-ready social insights

- Lean on the largest content database in the world—ingesting 100,000+ pieces daily—to power your reporting

Final Thought:

Credit card brands show what happens when design, data, and culture meet discipline. For social pros, the lesson is clear: acquisition strategy isn’t just for fintech—it’s for anyone ready to move beyond impressions and drive real impact with market leadership reporting and social media services built for growth.

How will you rethink your approach to growth?