Guest post by John Langan, Solutions Consultant at ListenFirst

Starbucks’ Marketing Strategy 2025: How to Turn Product Moments into an Always-On Social Engine

Starbucks’ Marketing Strategy is a masterclass on brand growth and evolution, one that is not afraid to pivot as needed without fear. The cafe chain was founded in 1971 at Seattle’s Pike Place Market, Starbucks has scaled from a single store to 40,199 locations worldwide by fiscal 2024, serving ~100 million customers each week (~14 million per day) through its cafés and digital channels. The brand’s footprint has accelerated rapidly, and Starbucks has outlined plans to reach 55,000 stores by 2030, averaging roughly eight net new stores a day. After a choppy 2024–2025 stretch marked by softer U.S. traffic and operational strain, the company is leaning into a back‑to‑basics reset under new CEO Brian Niccol, re‑centering the coffeehouse experience while keeping digital convenience, and using product drops and UGC‑friendly storytelling to power its comeback.

Starbucks’ current social strategy is relentlessly product‑led: launch a drink, package it for Shorts/TikTok, fuel it with UGC “how‑to‑order” culture, and then let seasonal IP do the heavy lifting. For QSR social teams, this is a clear example of transforming menu innovation into repeatable social IP without ballooning the content operation.

Metrics in this piece are from ListenFirst for Jun 1–Aug 11, 2025 (compared to Mar 21–May 31, 2025).

Starbucks’ Marketing Strategy foundations (pre‑Niccol): Experience + Rewards + LTOs

A quick baseline that still underpins Starbucks’ newer moves:

- Experience & the “third place.” Store ambiance and customization are core to perceived value; the brand markets comfort, consistency, and belonging in addition to product.

- Rewards + personalization. Starbucks Rewards, mobile order and pay, and data‑driven offers are the growth flywheel,gamified Stars, and targeted promos nudge frequency and ticket.

- Seasonal IP & innovation. A steady cadence of limited‑time beverages (e.g., PSL) keeps “newness” in the market and generates built‑in social moments.

- Premium positioning via quality & ethics. Product quality cues and ethical sourcing narratives support pricing.

- Omnichannel distribution & alliances. Cafés, drive‑thru, and pickup are complemented by RTD/CPG reach (e.g., the Nestlé Global Coffee Alliance) to expand availability and awareness.

- Audience focus. Millennial/Gen Z and working professionals value convenience, customization, and brand story.

- Digital storytelling. Social, UGC, and influencer collaborations carry the lifestyle message as much as the product.

Leadership shift: Brian Niccol’s playbook

Starbucks’ new CEO and chairman, Brian Niccol arrives with a rare blend of creative marketing and operational rigor. He helped make Doritos Locos Tacos a breakout growth engine at Taco Bell and led Chipotle’s recovery from food‑safety setbacks into a digital, inflation‑resilient performer, tightening procedures, accelerating service, and scaling online‑order infrastructure (e.g., “Chipotlane” pickup). Under his tenure, Chipotle’s sales roughly doubled to $9.9B by 2023, with stronger digital ordering and faster throughput. Colleagues credit his ability to pair brand‑building with process discipline and to operate alongside strong founder voices, which is useful at Starbucks.

What this likely means for Starbucks’ social narrative

- Product + process storytelling: Expect more content that makes operational excellence visible, speed, consistency, and barista craft, without losing the beverage‑as‑hero focus.

- App‑first design: Niccol’s track record suggests tighter loops from social to mobile ordering and loyalty moments (app‑only offers, timed pushes, order‑ahead prompts embedded in creative).

- Drop culture with discipline: Big, buzzy launches (à la Doritos Locos/Chipotle menu moments) married to store‑friendly execution, simplified builds, fewer bottlenecks, and clearer “how to order.”

- Culture radar: He’s known for institutionalizing a lightweight pop‑culture gut‑check, which can keep seasonal IP and collabs feeling timely while staying brand‑safe.

Store strategy: sunsetting Pick Up–only stores as part of “Back to Starbucks”

Starbucks is phasing out all Pick Up–Only locations by the end of FY2026 as part of a broader return to the brand’s coffeehouse roots. The move reframes closures as conversion and reinvestment: shifting guests from transactional grab‑and‑go outposts into warm, sit‑and‑stay cafés while keeping mobile ordering (still a material share of transactions) fully intact.

Where and how it’s rolling out

- Pilot remodels in the Hamptons (Bridgehampton), with New York City up next; broader 2025–2026 rollouts include Southern California and other major markets.

- Targeting ~1,000 U.S. remodels through the Coffeehouse Uplift program (≈ $150K per store), prioritizing speed and warmth.

What’s changing in‑store

- Seating returns (plush chairs, varied table types), with open power outlets, softer lighting, and layered textures/greens that read well on camera.

- Re‑introducing self‑serve condiment stations and simplifying the menu to reduce friction at the bar.

- Refreshing the front case and merchandising to support seasonal drops better and food attach.

Why it matters for social

- It gives the brand a clear narrative: efficiency and connection. Content can showcase cozy interiors, barista craft, and small human moments, without abandoning the app‑first flow.

- Launch content gets richer backdrops (full cafés vs. sterile counters), typically increasing watch time and shareability for macro pours and “how‑to‑order” clips.

Sentiment analysis: A reputational tailwind

- Positive social sentiment is up +33% vs. the same time last year, just prior to Niccol’s appointment.

- Negative sentiment has dropped -61% in the same period, signaling a broad cooling of criticism.

- Conversations about “how to order” are up +93%, indicating strong traction for customization‑friendly content.

- Mentions of opting to dine in have surged 31x compared to last year, aligning with the in‑store experience refresh.

Source: ListenFirst Sentiment insights, past 30 days vs. prior year.

Gamified loyalty: “Starbucks for Life” as a seasonal engagement engine

A significant part of Starbucks’ marketing strategy during the holiday season is their Starbucks for Life game, which functions as a high‑attention tentpole that drives daily app opens, social chatter, and partner amplification while keeping a no‑purchase‑necessary entry path. The mechanic is a classic collect‑and‑win: members earn/claim digital stickers via the app or site (with bonus plays tied to simple weekly activities), fill character cards, and unlock entries for prize tiers, from Bonus Stars and merch up to the headline prize (one free food or standard drink per day for 30 years). In the Dec–Jan window, Starbucks layers in cadence boosters (e.g., double or free plays on specific days) and cross‑brand tie‑ins (e.g., Delta, Marriott) that extend reach.

Why it works on social

- Built‑in narrative: “I’m one sticker away…” posts and reveal‑style unboxings generate organic UGC and community tips.

- Low‑lift creative: seasonal art direction and character cards are inherently shareable across Shorts/Reels/TikTok.

- App bridge: every play reinforces the app habit, making converting buzz into mobile orders and Rewards actions easier.

Sidebar: sentiment to watch

Some players say the final, rare sticker feels “impossibly hard,” which tends to spark Reddit threads and periodic media coverage each December. For planning purposes, anticipate a short-lived spike in questions/comments during the holiday window; monitor replies and keep messaging consistent.

Marketer takeaway

Seasonal, collect‑and‑win formats can be powerful if you (1) design obvious sharing moments, (2) tie plays to lightweight weekly actions (not just purchases), (3) partner for prize tiers that widen reach, and (4) keep disclosures and odds clear to maintain trust.

What’s Happening?

Scale that moves

- Total Followers across Instagram, Facebook, and TikTok: 66.7M, with Instagram ~35.8M, Facebook ~17.7M, TikTok ~10.5M.

- Net new followers: +121K; Fan Growth Rate: 0.18%.

Efficient cadence, rising yield

- 121 posts in‑period (Instagram 58, TikTok 59, Facebook 4).

- 2.44M Engagements on an intentionally focused posting mix.

- 132M public Video Views across FB/X/TikTok for the period.

YouTube momentum

- Subscribers 456K (+3%); +12K new subs (+33%).

- 40 posts (–13%) with 128M views (+12%), a strong signal that Shorts‑led packaging is compounding reach.

- Lifetime ceiling illustration:

- “NEW Strato Frappuccino”: 57,890,959 views

- “Summer‑Berry Refresher”: 21,462,581 views

- “NEW Iced Horchata Shaken Espresso”: 4,384,846 views

Community touch

- Response rate 0.19% overall (FB ~0.01%, IG ~0.11%, TikTok ~0.86%).

Tentpoles that travel

- TikTok (Jul 10): “I got a text” mobile order, 196,014 engagements, 3.2M views, 12.8K shares.

- Instagram (Jul 31): “Cotton Candy” how‑to, 69,779 engagements.

- Facebook (Jul 31): “Cotton Candy”: 8,105 engagements, 1,306 shares.

Pattern to note: Short‑form clusters around product drops (Strato, Summer‑Berry, Horchata). Hooks show motion in the first 1–2 seconds (pour/swirl), on‑screen text names the drink immediately, and the beverage, not the person, is the hero. The same edit language travels across platforms with light adaptation, creating efficient reach.

Brand/Marketer Implications (QSR Lens)

- Build a Drop Calendar, not a Content Calendar. Treat each new or seasonal item as a multi‑week IP arc (tease → launch → remix → how‑to‑order → community remakes). Spikes from launches carry halo effects to adjacent posts.

- Design for Short‑Form First. Macro pours, color contrast, and fast title cards are natively portable across Shorts/Reels/TikTok and can be stitched into YouTube compilations or behind‑the‑scenes edits.

- Operationalize “How to Order.” Tutorials and customization cues convert fans into co‑creators. Then, encourage remix prompts (“show us your twist”), then reward/reshare quickly.

- Make the App the Ending. Social is the attention engine; mobile ordering and loyalty are the conversion engine. Mirror Starbucks’ flow with app‑only flavors, timed push moments, and UGC contests that unlock add‑ons.

- Focus the Platform Mix. Double down where video velocity is highest (TikTok/IG/YouTube). Use Facebook surgically for share‑prone creatives that carry utility (how‑to, offers, seasonal moments).

- Measure Momentum, Not Just Posts. YouTube views and engagements grew off a slightly lower post count,proof that pacing launches and re‑using hero assets can beat a “just post more” mentality.

- Systemize Creative. A consistent pastel palette, product‑first framing, and legible on‑screen text let assets scale with minimal reshoots.

Platform or Cultural POV

- Seasonal IP as Social Currency. PSL, Cotton Candy, and summer flavors behave like franchises. Fans anticipate the return, expect new “recipes,” and participate through remixes.

- Beverage as Lifestyle Object. Visuals position drinks like fashion drops, color stories, texture, branded cups, so they’re inherently screenshot‑ and stitch‑friendly.

- UGC‑Adjacent by Design. Starbucks’ framing invites the community to complete the narrative (“Here’s how to order…”). That participatory setup is why simple macro shots travel.

- YouTube as a Reliability Layer. Shorts extend reach, while evergreen videos compound views over time, giving launches a longer tail.

What This Looks Like in Practice (Narrative Flow You Can Borrow)

Act I: Anticipation

- Teasers (5–8 seconds), color‑first thumbnails, and title cards that name the hero flavor.

- Behind‑the‑scenes snippets (ingredient close‑ups, cup branding, limited‑time cues).

Act II: Launch Day

- A‑roll macro pour + ASMR, “how to order” subtitle, and a barista quick‑cut (3–7 seconds).

- Cross‑post to IG Reels and TikTok within 90 minutes; publish a YouTube Short with a variant thumbnail.

- App‑only nudge in the caption; pin in TikTok profile.

Act III: Remix & Community

- Invite UGC remakes, duet stitches, and “two‑ways to order” carousels.

- Reshare the top five within 24 hours; add a YouTube compilation by end of week.

- Run a light paid boost on the best‑performing organic clip to seed additional remakes.

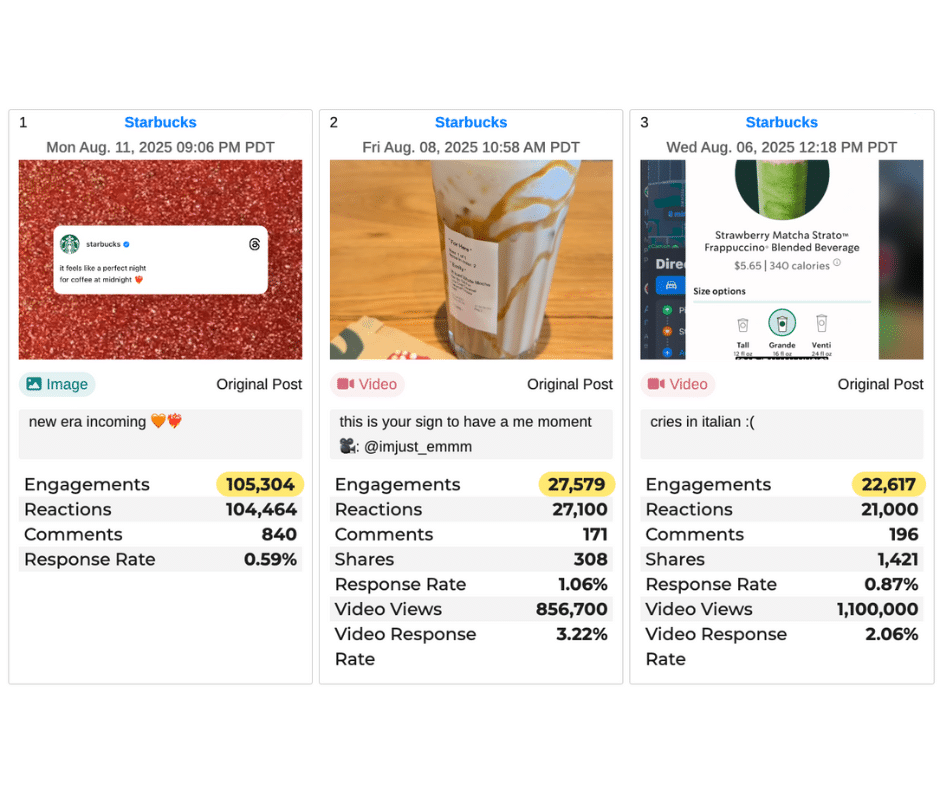

Top 3 posts from the date range.

Repeatable Content Archetypes (From This Period’s Best Posts)

- Drop Trailer: High‑contrast color, 1–2 word title cards (“NEW STRATO”).

- Macro Pour / Texture ASMR: Ice, foam, and shimmer; minimal copy; 3–6 seconds.

- How‑to‑Order / Customization: On‑screen steps; barista POV; saves and shares spike.

- Moment Marketing: Light tie‑ins (e.g., Father’s Day) that let the beverage remain the hero.

- Ingredient Close‑up: Satisfying scoops and swirls; supports both launches and evergreen.

Key Takeaways for Marketers

- Anchor your month on 2–3 drop tentpoles; surround each with 5–7 supporting shorts.

- Open hot: motion in the first 2 seconds; name the item on‑screen; keep captions tight.

- Create UGC prompts and reshare winners within 24 hours to reward participation.

- Atomize assets: one hero shoot → Shorts/TikTok → IG carousels → FB shareable cuts → YouTube compilations.

- Use app‑only perks and limited windows to convert buzz into orders and loyalty actions.

- Monitor response rate and save‑to‑order behaviors,not only likes,to tighten the brand/CRM loop.

- Maintain a brand palette + framing system so content is consistent yet modular across channels.

Final Thought

Starbucks’ marketing strategy shows that in QSR, social growth isn’t about posting more; it’s about turning product launches into cultural moments and letting customers carry them. What’s one upcoming menu item you can elevate into a two‑week “mini‑franchise” with teasers, how‑tos, and UGC remixes?