Why unchecked growth can backfire and how smarter segmentation, rollout, and social strategy help brands scale without self-disruption.

In the race to grow—more stores, more content, more formats—brands often overlook a critical risk: internal cannibalization. Expansion promises reach and relevance, but without a cohesive structure, it can displace revenue, confuse audiences, and erode brand equity.

This isn’t just a physical footprint problem. Across social platforms, overlapping accounts, campaigns, and creators can dilute impact rather than extend it. Whether in QSR, streaming, or TikTok content calendars, the same pattern applies: growth without segmentation undermines itself.

1. What’s Happening?

Across industries, scale is no longer enough. Structure matters more.

Streaming: The Cost of Collapsing the Window

SVOD viewership rose 192% as platforms pushed to expand their content libraries. But much of that audience came from earlier-stage monetization models like TVOD. Studios like Sony have responded by reintroducing tiered release windows to preserve value.

This logic is mirrored in social. Brands often post teaser clips, full campaigns, and behind-the-scenes footage across multiple platforms in a short window. Instead of building momentum, this floods feeds with similar content, exhausting engagement before the campaign peaks.

Pacing isn’t just a media distribution tactic; it’s a content performance strategy.

QSR: Proximity Without Purpose

A national burger chain found that new store openings cannibalized 6–20% of revenue from nearby locations. Delivery, while expanding access, often substituted for dine-in traffic, thus producing marginal gains but lower margins.

On social media, a similar effect occurs when regional brand accounts or franchise partners repost identical campaigns. Rather than amplifying reach, this fragments Engagement and weakens platform signals. When algorithms detect overlap, visibility often drops across the board.

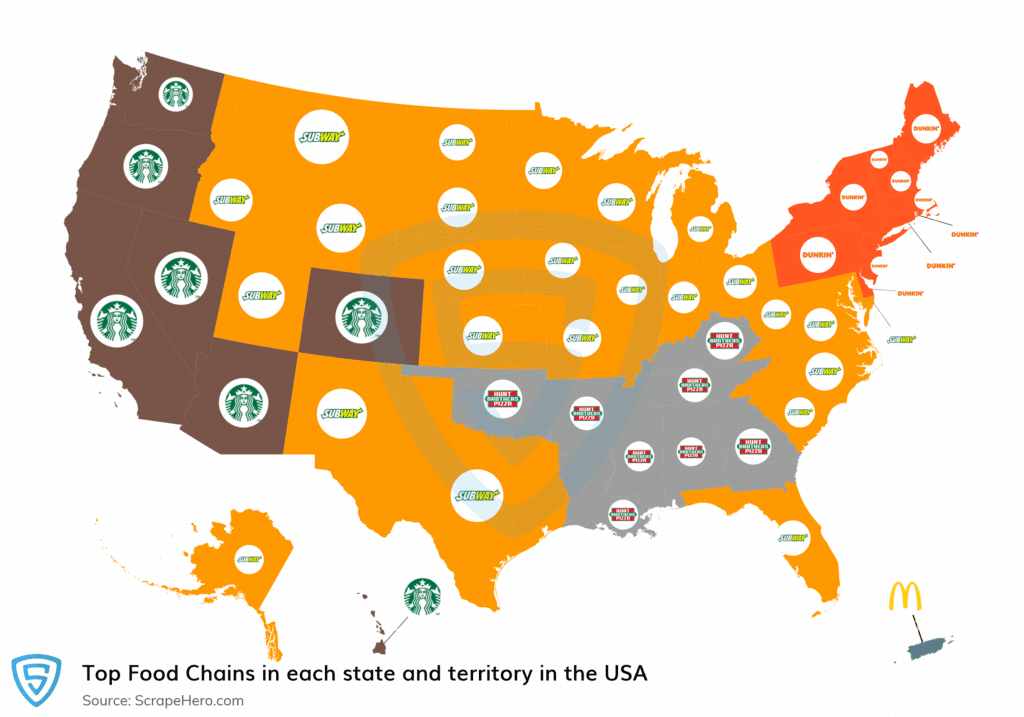

Most locations per state in 2019

Most locations per state in 2025

Subway: Saturation Without Segmentation

Subway’s low-barrier franchise expansion led to dense clusters of locations competing against each other. AUV fell from ~$482K in 2012 to ~$420K by 2016, prompting store closures and franchisee backlash.

Franchise systems often face challenges in maintaining cohesive digital brand experiences at scale. According to an analysis by Regroup, 95% of franchise brands have incomplete, inactive, or poorly maintained local social pages, which can fragment audience engagement and dilute overall brand equity. In many cases, the lack of centralized oversight or content coordination leads to redundant messaging, inconsistent tone, and diminished algorithmic performance—especially when multiple locations push similar content without strategic pacing or differentiation. As brands re-evaluate both physical and digital expansion, more are applying the same precision to their social architecture as they do to real estate placement and product rollouts.

Hospitality: Clear Architecture Wins

The FTC found measurable cannibalization when hotels opened under the same brand in close proximity. Marriott reduced this risk by segmenting its offerings—Moxy, Courtyard, and Ritz-Carlton target distinct traveler types.

This segmentation is also precise in their social presence. Moxy leans into TikTok-native humor and lo-fi editing, while The Ritz-Carlton emphasizes luxury visuals on Instagram. Rather than compete for the same user, each brand carves out a unique digital identity.

2. Brand & Marketer Implications

Internal competition is rarely accidental. It’s a byproduct of uncoordinated growth.

For marketers, these patterns show up in product launches, campaign planning, and content calendars. When everything is everywhere, performance starts to cannibalize itself.

The most strategic teams are:

- Using geo and engagement data to model overlap across store locations and social surfaces.

- Segmenting creator strategies to avoid redundant voices or identical messaging.

- Staggering rollouts by content format and platform to avoid saturation.

Example: Starbucks’ Reserve Roasteries are positioned as premium destinations—and the content reflects that. While the main brand leans into routine coffee culture, Reserve channels highlight design, rarity, and storytelling. The result: two narratives that coexist without stepping on each other.

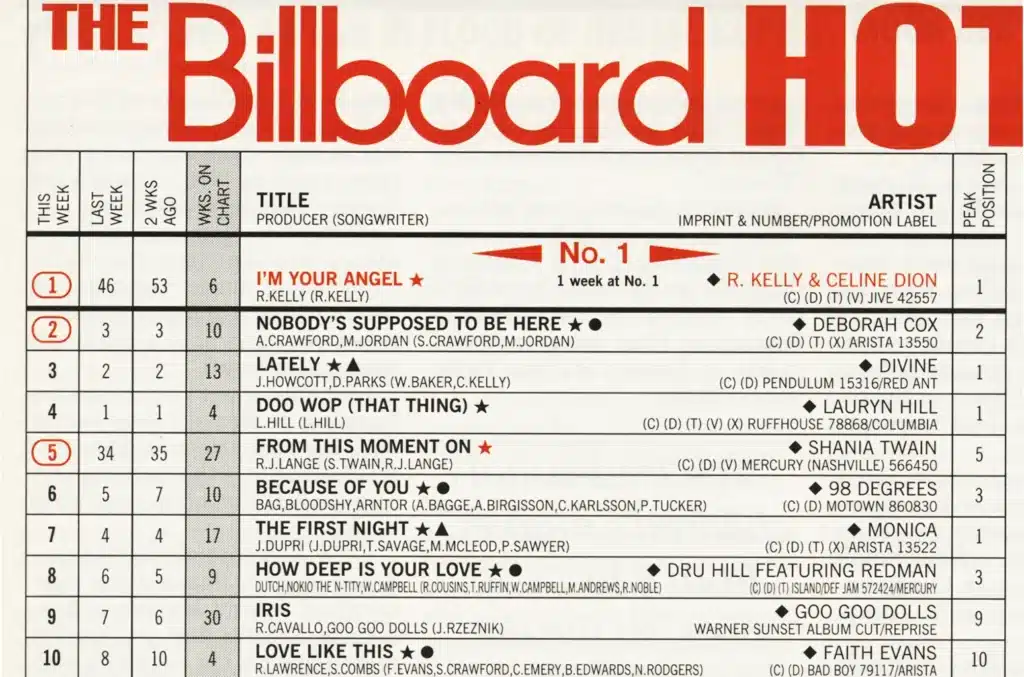

Personal Lens: Lessons from Music Marketing: Timing, Targeting, and Avoiding Self-Competition

Earlier in my career, I worked in music—specifically marketing tours and album cycles. Anyone who’s been through a record release knows how structured and unforgiving the timelines can be. To chart, it’s not enough to sell a million albums; you have to sell them within a specific timeframe, and historically, through certain formats.

At the same time, artists often have exclusive retail partnerships—maybe a special vinyl at Target or a deluxe CD at Walmart. These partnerships come with their own timelines and performance thresholds. If the retailer doesn’t see results quickly, the deal might not continue.

This puts pressure on marketers to promote each version strategically. Push the Walmart edition too hard in a region where fans avoid Walmart, and you waste time and attention. Ignore it completely, and you risk losing shelf space. You learn to segment by geography, channel, and even audience values.

To manage this, I would layer an artist’s email list over Meta’s ad targeting tools, then segment by recent behavior and geography. For example, if we were promoting Band A’s Walmart-exclusive album in Ohio, I’d use Meta to target fans who had been within five miles of Walmart stores in the last 30 days—by uploading specific store addresses and matching them to location data. This allowed us to prioritize the correct SKU to the right audience without wasting impressions on fans unlikely to engage with that retailer.

That experience reinforced how easily growth with more SKUs, more partners, more formats can undercut itself without careful planning. The same rules apply in today’s digital campaigns. Whether it’s an exclusive product drop or a new content format, not every message is for every market.

Interestingly, QSR and fast food brands have long understood this, even if they don’t always act like it. McDonald’s, for example, maintains regional menus that reflect hyper-specific customer preferences. You’ll find Spam in Hawaii, poutine in parts of Canada, and McSpaghetti in the Philippines. In the U.S., certain LTOs (limited-time offers) are quietly geo-targeted to avoid overlap or fatigue. These decisions aren’t just culinary—they’re strategic. By tailoring menu items to specific markets, McDonald’s avoids self-competition and keeps regional audiences engaged without undermining broader national campaigns. It’s a reminder that audience segmentation isn’t a niche tactic; it’s a mass-market necessity.

I see this play out in real time as someone based in Columbus, Ohio. Columbus is one of the most commonly used test markets in the U.S., thanks to its demographic diversity and proximity to nearly 50% of the U.S. population within a 500-mile radius. Brands often roll out new QSR menu items or limited-run products here before deciding whether to take them national. Sometimes, we see things that never expand beyond our region. Not because they failed, but because they were meant to quietly test appeal, supply chains, or brand stretch. It’s a reminder that even the biggest players understand the value of controlled experimentation and localized strategy. Whether they always practice it or not.

And sometimes, I wonder what never made it out of Columbus because my neighbors didn’t like it. What menu items, campaigns, or products quietly died in test because they didn’t resonate with this particular market? It’s a strange kind of influence and a reminder that even with all the right modeling, outcomes still hinge on human behavior in very specific places. For your sake, I hope you get a chance to enjoy Diet Cherry Coke again like I have today. It’s perfection.

3. Platform and Cultural POV

Convergence has increased complexity—and internal conflict.

Consumers expect seamless, omnichannel experiences. But this interconnectedness also means brands are more likely to compete with themselves.

On social, the signs are subtle but real:

- Posts that launch too close together split reach and suppress discovery.

- Paid content that overlaps with organic can trigger frequency caps or drop-off.

- Multiple creators posting the same message simultaneously can flatten overall resonance.

Algorithms increasingly reward originality, timing, and format diversity. Simply duplicating a campaign across platforms or flooding feeds with variants risks performance drag. Innovative brands adapt by mapping out creator roles, pacing multi-surface content, and allowing momentum to build between launches.

4. Key Takeaways for Marketers

Forecast Overlap, Not Just Growth

Use location and engagement modeling to predict cannibalization. Map where audiences or content touchpoints are already saturated.

Segment Creators Like You Segment Products

Assign distinct tones, formats, or audience goals. Repetition may feel safe, but it usually underdelivers.

Pace Rollouts With Intention

Stagger campaign drops by channel and format. Tease with short-form, follow with hero content, then deepen with behind-the-scenes or community-led storytelling.

Track Intra-Brand Performance

Look beyond total impressions. If one channel or product gains at the expense of another, you haven’t grown, you’ve shifted.

Align Internally Across Teams

Coordinate content, paid, and regional efforts. A unified calendar helps avoid campaign pileups or message fatigue.

5. Final Thought

Brands don’t just compete with others—they compete with themselves.

Whether it’s a sandwich shop next door, a streaming window launch, or a Reels post that undermines a TikTok campaign, cannibalization is often self-inflicted.

Growth isn’t the enemy. But it needs structure, segmentation, and sequencing to deliver value instead of volume.

Ask your team:

Where might we be unintentionally displacing ourselves in the market, in feed, or in messaging?

And what would it look like to grow with precision, not just speed?